Best 5 Mutual Funds for SIP Equity Based in 2021

16 July 2021

Mutual Funds are today some of the most secure forms of investment. We work hard for money, but it's essential to put your money to work for you. That's where mutual funds come in. If you are risk-averse and want a diversified portfolio with expert-level monitoring, mutual funds are a suitable investment for you. The Best Mutual funds diversify your portfolio into stocks and ensure they're monitored by experts. They keep an eye on every move of the market to get you the best possible profits. With MFonline you get the best advice from Mutual Funds experts based on your risk appetite at your convenience.

SIP's are a great way to benefit from mutual funds. Under this, you invest a fixed amount every month in the mutual fund of your choice. In addition, SIP's are helpful to average out your investments and hedge your losses. And today, let’s discuss some of the best mutual funds in the market for SIP (Systematic Investment plan).

Top 5 Mutual Funds for SIP

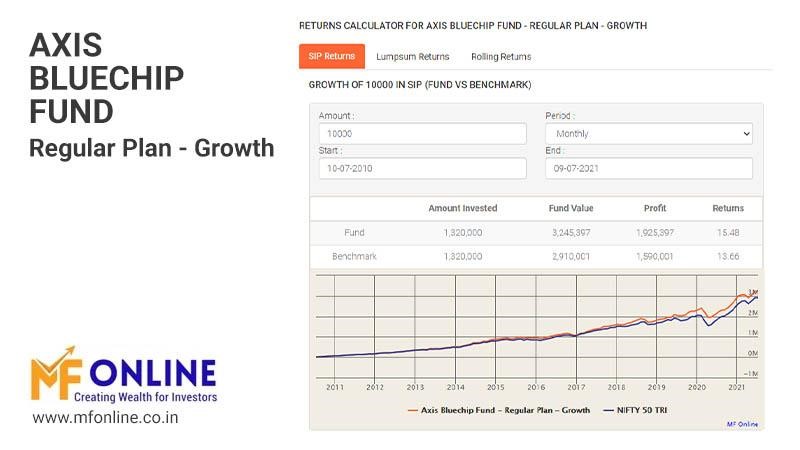

Axis Bluechip Fund

The Axis Bluechip Fund is one of the largest in its category, with a fund size of ₹27,142 crores. More than 96% of the fund is invested in the Indian equity market, out of which almost 85% is invested in large-cap stocks. The rest is divided into Futures and Option holdings, Mid-cap stocks, and AXIS FDs. The fund is invested in 41 stocks and has been showing brilliant SIP returns ever since its inception. A SIP investment for ten years is now worth more than 230% of the original investment. Although this is considered a very high-risk fund, it is the best mutual fund for people willing to invest for a period of 4-5 years in search of higher returns. However, there is a possibility of low to moderate losses in the investment horizon.

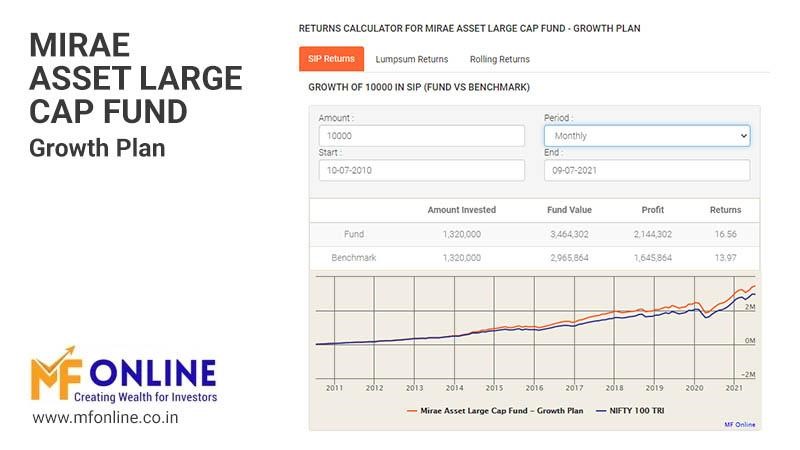

Mirae Asset Large Fund

Mirae Asset Large Cap Fund is another fund that invests mainly in Large-Cap Equity. The Large-cap equity sector is one of the most profitable and safe investments. More than 97% of the fund is invested in Indian stocks, out of which 71% of it is invested in large-cap stocks. The fund has 61 stocks in its portfolio and has given 144% returns in a 10-year SIP. However, one should be prepared to bear moderate losses, but the fund has a good performance so far. And is one of the best mutual funds for SIP in its category Especially, when it comes to SIPs. Anyone looking to invest their money for a good 3-4 years should opt for this stock to diversify their portfolio efficiently.

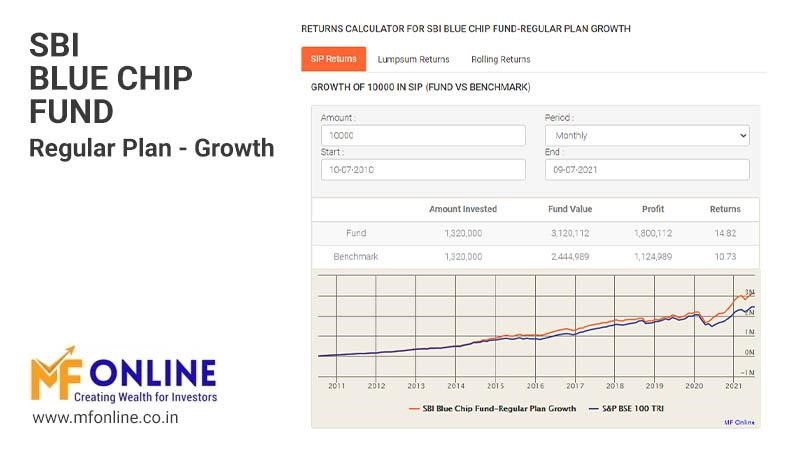

SBI Blue Chip Fund - Regular Plan-Growth

The SBI Blue Chip Fund has a market capitalization of more than ₹28,210 crores which occupies more than 14% of the investment in its category. Though it is considered a moderately high-risk fund, it has a very good CRISIL Rating of 4, which is more than the average rating a fund in its category gets and is also the reason this is considered one of the best mutual funds in the investment market right now. The fund is divided into 53 equity stocks. Almost 97% of the fund is invested in Indian Stocks, out of which more than 73% is invested in large-cap stocks. The rest is invested in mid-cap, small-cap, and some very low-risk debt securities.

The fund has given more than 122% returns for a SIP started 10 years ago and has been performing pretty well ever since its inception. It would be the best mutual fund for a person looking to invest for a good 3-5 years and expecting high returns. However, just like in all other funds, one needs to be prepared for possible moderate losses.

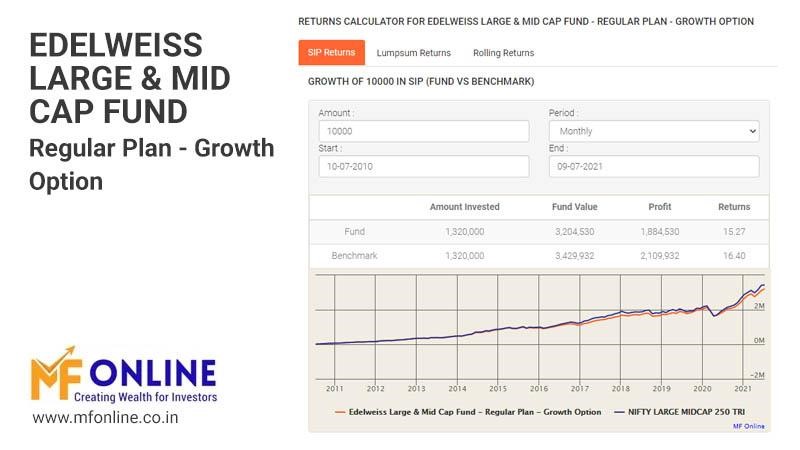

Edelweiss Large and Mid Cap Fund - Regular Plan-Growth

Edelweiss Large and Mid Cap fund is a very good fund with great potential. The fund has a CRISIL Rating of 5 which is very good for mutual funds. The fund's size is 778 crores, about 97% of which is invested in Indian stocks. The fund includes 65 equity stocks out of which about 50% are large-cap stocks and 33% are mid-cap stocks. The rest of the fund is invested in small-cap stocks and TREPS. The fund has given close to 131% returns on a SIP started 10 years and annualized returns close to 55% in a SIP for the past year. The fund has been performing well ever since its inception and continues to give good returns. Anyone looking for high returns and ready to invest for a few years should go for this fund. Its amazing CRISIL rating gives it an edge over the other stocks in its category and is also the reason it is considered one of the best mutual funds in the market.

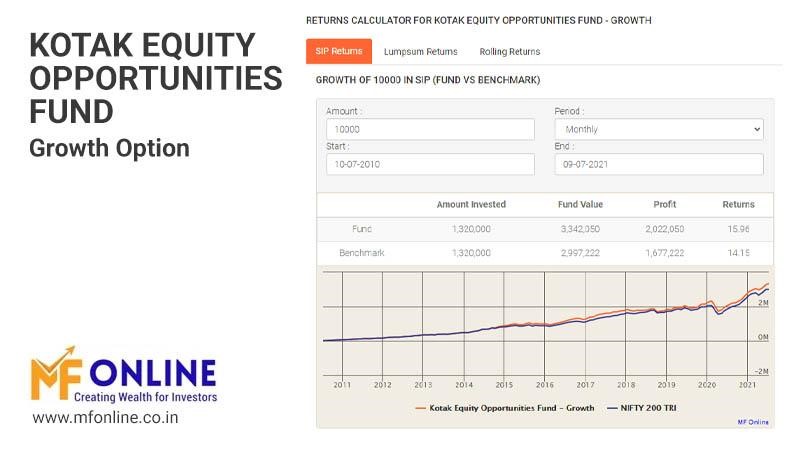

Kotak Equity Opportunities Fund - Growth

Kotak Equity Opportunities Fund had 56 Indian Equity Stocks in its portfolio. The fund comprises about 48% of Large-cap stocks and 33% mid-cap stocks while the rest of it is divided into small-cap stocks and other securities. The fund's size is more than ₹6361 crores which is 7.6% of the investment in its category. Though the fund is considered moderately risky its CRISIL rating is 4 which is better than average for a fund of its category. It has provided almost a 140% return on a SIP started 10 years ago. It comprises some of the best-performing stocks in the market and is a pretty good investment for a person looking to invest for a few years. However one always needs to be ready for the possibility of some losses.

These were the Best 5 Mutual funds for SIP in 2021. So, what are you waiting for? It's time to invest in the Mutual fund you find the most appropriate for yourself and grow your investment.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.