Best Liquid Mutual Funds in India

13 September 2021

Mutual funds may meet the demands of every individual. There are a plethora of investment options to select from, both short-term and long-term. As a result, if you're new to investing and examining your options, it's a good idea to take some time to figure out what your major investment goal is.

Debt funds are divided into 16 distinct categories, ranging from overnight funds to 7-year funds. Debt funds include liquid mutual funds. SEBI is taking this step to make it easier for investors to identify the proper sort of fund without being overwhelmed by the options. Here, we'll look into the Best Liquid Mutual Funds in India and discuss all you need to know about them before you invest.

What are liquid funds?

Liquid funds are nothing but a category of debt funds that predominantly invests in marketable securities which come with a maturity period of up to 91 days. The asset allocation of liquid funds is made towards commercial papers, treasury bills, certificates of deposits, and so on. It is an open-ended scheme that does not require a lock-in period. The difference between liquid funds and debt funds is that Liquid funds have a relatively low-risk profile. So, investing in liquid funds is a good option for risk-averse investors. In addition, unlike other mutual funds, liquid funds' net asset value (NAV) is determined over 365 days, whereas the changes in other mutual funds occur daily. However, liquid funds are not completely risk-free; a change in interest rates might result in a price differential in debt instruments. NAV, on the other hand, does not vary dramatically.

Who should consider investing in Liquid funds?

Liquid funds are excellent for investors having a large sum of money that hasn't been invested and are searching for low-risk, short term liquid funds to invest in. Your money can generate higher returns while maintaining the same liquidity as if it were just sitting in a savings account. Many investors start with liquid funds before moving on to equities funds. They begin by investing in liquid mutual funds, then transition to an equity fund becomes easy as the investors gain knowledge of the market conditions along with their financial objective. This allows them to invest in equities funds in stages and take advantage of rupee cost averaging.

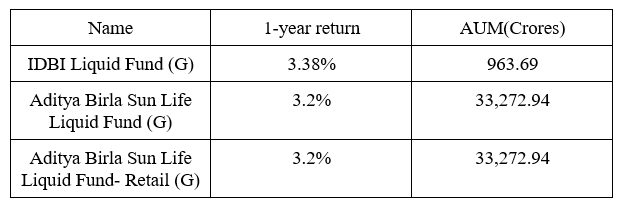

Top 3 Liquid funds to invest in India

These are the top 3 best liquid funds currently being recommended by our advisor MFonline:

Benefits of Investing in Liquid funds

1. No Exit Load

Liquid funds are open-ended funds. This means the investor need not be committed to the funds for a specific tenure. Investors can withdraw liquid fund units whenever it is convenient for them. Most liquid funds don't charge an exit load if you hold them for more than a week.

2. Emergency funds

Because liquid funds are surplus money invested by investors, there is no lock-in period, so you can get the most out of them. The underlying assets of a liquid fund have a maturity of up to 91 days, therefore there isn't much volatility. As a result, an investor may profit from the gains on liquid funds while still having the option to withdraw their cash in the event of an emergency.

3. Diversify your Portfolio

The investment horizon may change depending on the financial goal of the investor. Parking money in risk-averse portfolios can give them better investment knowledge about equity mutual funds that may allow them daily to diversify their portfolio.

4. Low Cost

Liquid funds, like all other mutual fund schemes, levy an annual fee for fund management services. This is known as the expense ratio, which is a proportion of the fund's total assets. Most debt investors choose funds with a lower expense ratio since it allows them to maximize their returns. Furthermore, most liquid fund managers invest and keep the investment until it matures thereby keeping the expense ratio low.

Final thoughts

In conclusion, we can say that the best liquid mutual funds in India are the best mutual funds suited for investors who want reasonable returns at lower risk and as liquid as savings accounts deposits.

Disclaimer: Mutual fund investments are subject to market risk; read all scheme related documents carefully.