Best Performing Mutual Funds In India

08 September 2021

If you're searching to invest in best performing mutual funds in India, the experts at MFonline can help you manage your investment. The following list is based on the fund's previous performance, with higher returns depending on market volatility. Before learning about best performing mutual funds in India let's understand what mutual funds are and how do they work?

What are Mutual Funds?

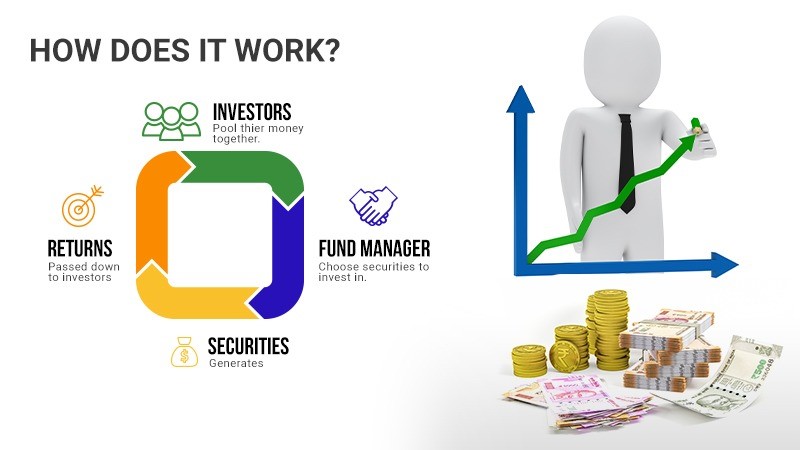

Mutual funds are one of the most sought-after investment options these days. A mutual fund is an investment company that typically pools money from several individuals and institutional investors with a common investment objective. A professional fund manager is appointed to manage the pooled investment. The manager then allocates the money in securities such as stocks, bonds, short-term debts, etc. This combined holding of mutual funds is also called a portfolio.

The fund manager and his team make all the decisions regarding the investor's portfolio. When an investor buys a particular stock, he becomes a partial owner of the mutual fund company and its assets. The best mutual funds diversify your portfolio by investing in equities and ensuring that they are closely managed by professionals. The fund managers keep a close eye on every market move for the best mutual fund to invest in, to maximize your earnings.

With MFonline, you can obtain the finest advice from Mutual Funds specialists at your leisure, based on your risk appetite. Everyone should think about putting money into mutual funds. It aids in the achievement of long-term objectives. Realistic ambitions, like buying a vehicle or a house, can be funded with mutual fund rewards.

In everyday life, wherever and whenever we make a big purchase, we weigh all of the benefits and drawbacks of the product before making a decision. In the same manner, before investing in any mutual fund, one must analyze it. In general, everyone wants to get the most out of their mutual fund investments.

In this blog, We will guide you on how to choose and make a better-informed decision before investing in the best mutual fund. Below listed are some of the top-performing schemes in regular plans as of 20.08.2021

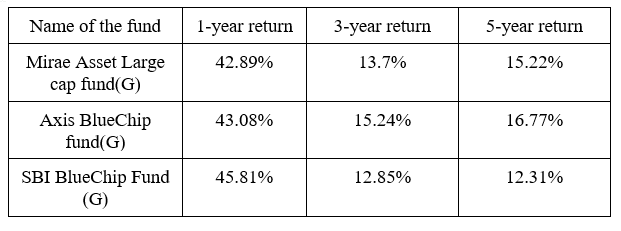

1. Equity Large Cap Funds on 5-year returns

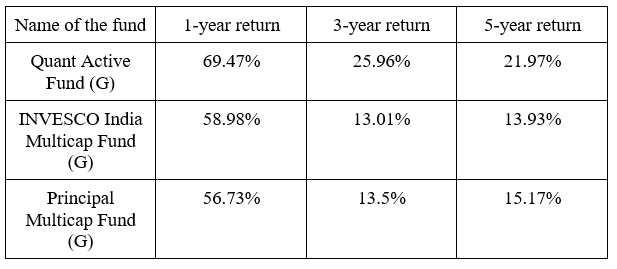

2. Equity Multi-Cap Funds on 5-year returns

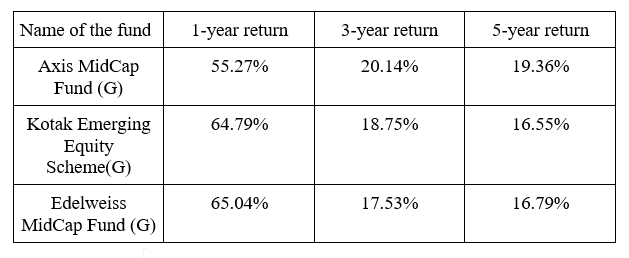

3. Equity Midcap Fund on 5-year return

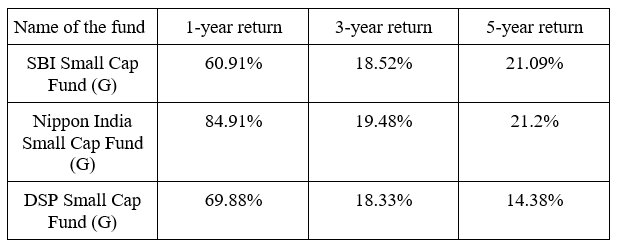

4. Equity Small Cap Fund on 5-year return

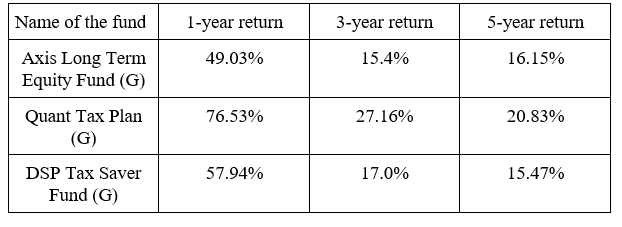

5. Equity Linked Saving Scheme (ELSS) on 5-year return

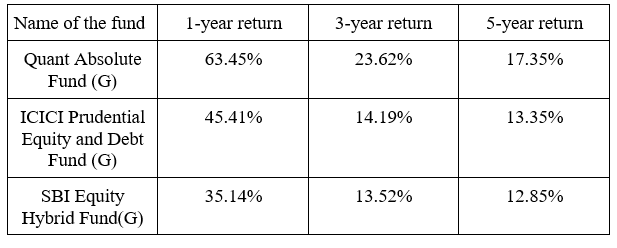

6. Balanced Fund (aggressive) on 5-year return

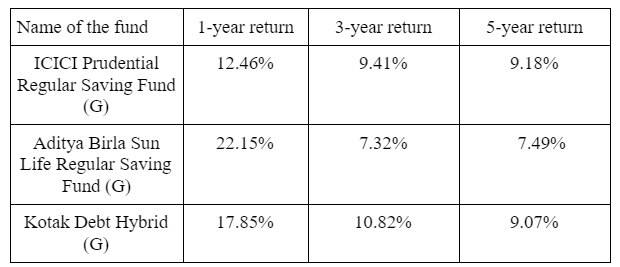

7. Balanced Funds (Conservative) on 5-year return

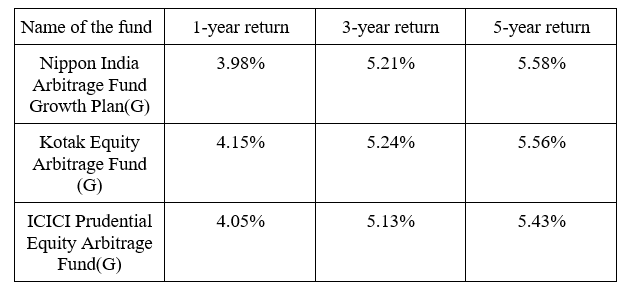

8. Arbitrage Funds on 5-year return

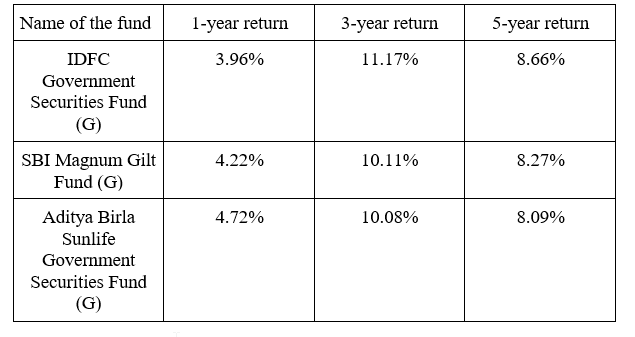

9. Government Securities Fund (Gilt) on 5-year return

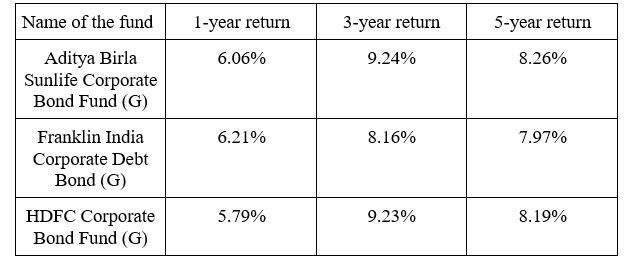

10. Corporate Bond Funds on 5-year return

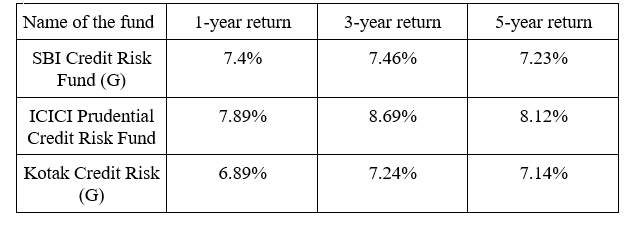

11. Credit Risk Funds on 5-year return

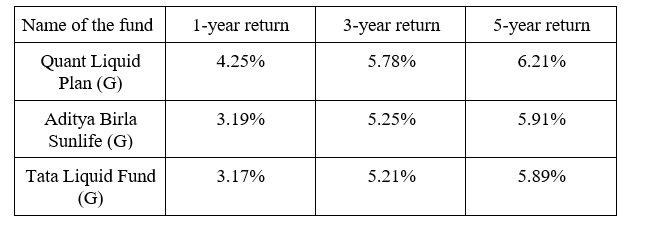

12. Liquid Risks on 5-year return

Now that we know which mutual fund is the best performer, we may invest in it. Let's understand different ways and means to help you choose what's best for you!

In everyday life, wherever and whenever we make a big purchase, we weigh all of the benefits and drawbacks of the product before making a decision. In the same manner, before investing in any mutual fund, one must analyze it. In general, everyone wants to get the most out of their mutual fund investments.

In this blog, We will guide you on how to choose and make a better-informed decision before investing in a mutual fund.

Risk Tolerance:

Before investing in any Mutual Fund, you must first determine your objectives and risk tolerance. Decide if you want to invest for the long or short term. Ask yourself the following questions

- How long do you want to keep your investment?

- Do you think there will be any liquidity issues shortly?

- How much risk are you willing to take?

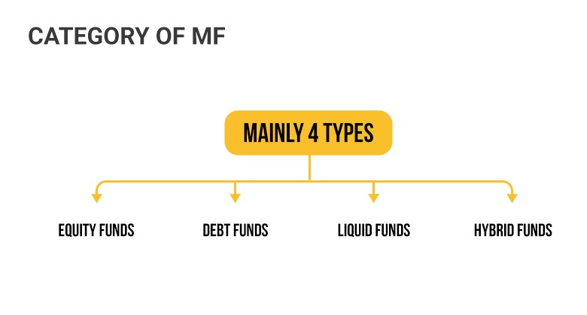

Category of Mutual funds

Once you have decided and calculated your risks, the next step is to decide the Category of mutual fund you want to invest in. Broadly, it is divided into 4 Categories

- Equity Funds

- Debt Funds

- Liquid Funds

- Hybrid Funds.

Mutual Fund Fees

Mutual Fund Companies make money by charging fees to the investors. The fees associated with mutual funds are divided into two categories mainly management fees and operating fees. Management fees also called maintenance fees cover charges like legal, marketing, administrative, office supplies, etc. these costs are responsible for ensuring that the mutual fund is operated appropriately and as per the Securities and Exchange Commission's regulations. Another management fee that companies incur is that of hiring a portfolio manager which is the largest component of the management fee.it can be between 0.5 percent and 1 percent of the fund's assets under management(AUM). The management fee is crucial for the fund since the most expensive aspect of operating a mutual fund is recruiting and retaining an investing staff.

Based on the above points, even an individual with no prior market expertise can begin investing in a mutual fund. MFonline's market specialists can assist and guide you in selecting the best performing mutual fund in India to meet your financial objectives.

Disclaimer: Mutual fund investments are subject to market risk; read all scheme related documents carefully.