How to Start Investing in IPOs In India

12 October 2021

Investors are spoiled for choices with IPO flooding in the equities market. As a result, it might be challenging to know which IPO is best on the market. First of all, though, let us begin with the basics of IPO and learn how to invest in an IPO. So allow us to begin with the definition of IPO.

IPO Meaning

The word IPO stands for Initial Public Offering. It is a process wherein a private company raises money by selling its shares to the general public. IPO also helps the company with capital inflow that might help the company to expand and grow quicker

IPO Frenzy in India

Before continuing further, let us state some facts about IPO. The calendar year 2021 is anticipated to be a record year for investment in IPOs in India amid a global pandemic. All thanks to Zomato Ltd- This food delivery company went public in July, acting as an eye-opener for many people in India and creating pathways for similar private companies to go public. However, few significant brands like PayTm, Nykaa, LIC, and many more are slated to hit the market before the end of this financial year.

So, if you are interested in knowing more about what, why, and how to invest in IPO, read ahead. Now that you are familiarized with the concept of what an IPO is, let us move on to why you should invest in IPO.

Why Should You Buy IPO Shares?

Before you take a leap, there are certain things you should bear in mind:

- Long term financial planning is essential

- Determine your investment criteria, risk appetite. Then, you will be in a better position to select an IPO listing that best suits your criteria.

- Before selecting an IPO, do thorough research about the company, its past performance.

- Check whether the IPO is reasonably priced.

- Is the market bullish or bearish?

- Use all the available resources that the company puts out before the listing begins, such as reading the details in their prospectus, their expansion ideas, long-term goals, etc.

Investing in the company's equity is one of the most excellent strategies to attain your goals in the long run. The price of the stock you hold might grow annually and can enable you to build wealth.

Companies can issue IPO via two methods. Fixed price offering, book building offering, or a combination of both. First, let us find out about the types of IPO.

Fixed Price Offering

In a fixed price offer, the issue price is announced in advance to the investors for the initial sale of shares. Demand for the stock is only known to the investors after the closing of the IPO.

Book Building Offering

Unlike fixed-price issues, the IPO issuing company provides a 20% price band to the investors. However, before the final price is established, the interested investors offer the shares. In this method, investors must indicate how many shares they want to acquire and how much they are ready to pay for each share.

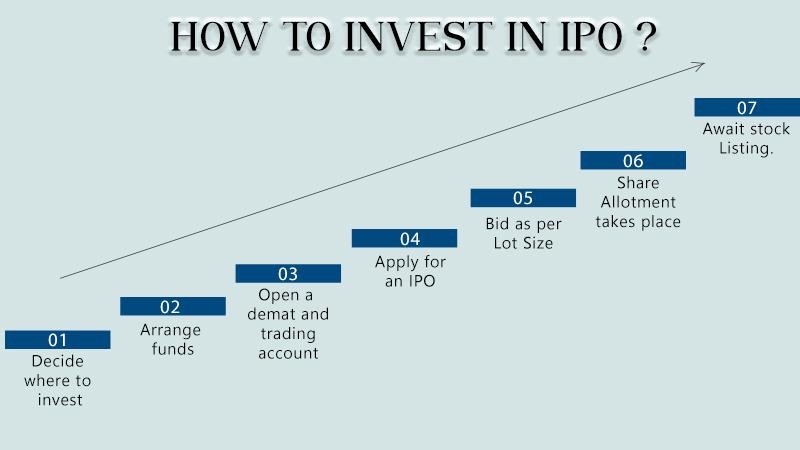

How to Invest in IPO?

Interested investors are required to follow these steps to invest in IPO:

Decision

Arranging Capital

Open Demat-cum-trading account

Application Process

Bidding

Allotment

It can get intimidating for new investors to decide which IPO to apply for. However, the investors can make informed decisions after reading the prospectus of the issuing company.

If an investor has decided on an IPO he wants to invest in, the next step is to organize the money.

An investor needs to open a Demat and a trading account to invest in IPO shares. Then, an investor can apply through their trading account. Opening a new Demat account may be relatively straightforward for a new investor and can be done electronically by submitting Aadhar Card, PAN, and other identity proofs.

Following the investor's activation of a Demat cum trading account, the following investment stage in IPO should be the Blocked Account Supported Application. In the case of payment (ASBA) process is followed. That implies the money will be blocked from your bank account until the allocation is in progress. When the IPO is closed, the specified amount secured is released if no shares are allocated to you.

As explained above, the company decides a price range in the types of shares, and investors have to bid in the given price range. The lot size of the shares is referred to as the minimum number of shares that an investor applies for in an IPO.

Suppose the investor is lucky enough to get a full allotment. In that scenario, the entire amount is debited from the bank account. Within six working days, the investor will get an allocation letter once the IPO process has ended. Sometimes owing to a large demand for shares, partial shares may be allocated; in that case, the required amount is debited while the remaining amount is unblocked.

The above mentioned are the detailed steps on how to invest in IPO. Once the following steps have been appropriately implemented, the investor must wait for stock listings in the share market. It usually takes seven days to complete the shares.

Conclusion

An IPO may be a great experience to engage in the stock market. Still, an investor must evaluate the particular IPO he wants to invest in, just like other investments

Frequently Asked Questions

How Can I Buy IPO in India?

After an investor has found a suitable opportunity to invest in a particular IPO, you can open a Demat account to apply for IPO shares. Also, you can read the blog to understand the process of how to invest in an IPO.

Is IPO A Good Investment In India?

Through IPO, Indian Companies have raised more than Rs. 27 417 crores in the first six months, the highest in at least a decade. It makes IPO an attractive choice for investors to benefit from these companies going public.

Disclaimer: All mutual funds are subject to market risk. Read all scheme-related documents carefully.